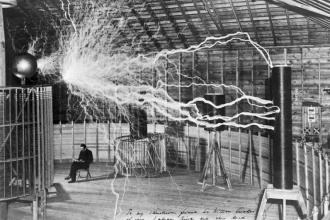

Tribute to Larry Roberts - Under Appreciated Internet and Packet Switching Pioneer

Introduction: Only a small handful of people can truly be called the grandparents of the Internet, but only one of them was also a pioneer in X.25 public packet switching data networks. That individual was Larry Roberts, PhD, who died of a heart attack on December 26, 2018 at his home in Redwood City, California. He was 81 years old...